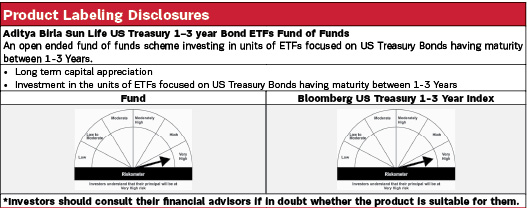

Aditya Birla Sun Life US Treasury 1-3 Year Bond ETFS Fund Of Funds |

|

| An open ended fund of funds scheme investing in units of ETFs focused on US Treasury Bonds having maturity between 1-3 Years. |

| Data as on 31st March 2024 |

*Fresh subscriptions/ switch-in application(s) including fresh registrations for subscriptions under and existing systematic transactions are being suspended temporarily till further notice.

|

Fund Details |

|

Investment Objective |

|

| The investment objective of the Scheme is to generate returns that are in line with the performance of units of ETFs focused on US Treasury Bonds having maturity between 1-3 Years. The Scheme does not guarantee/indicate any returns. There is no assurance or guarantee that the investment objective of the Scheme will be achieved. |

|

|

| Fund Manager | |

|---|---|

| Mr. Vighnesh Gupta & Mr. Bhupesh Bameta |

| Managing Fund Since | |

|---|---|

| November 02, 2023 & October 31, 2023 |

| Experience in Managing the Fund | |

|---|---|

| 0.4 Years & 0.5 Years |

| Load Structure (as % of NAV) (Incl. for SIP) | |

|---|---|

| Entry Load | Nil |

| Exit Load | For redemption/switch out of units on or before 30 days from the date of allotment: 0.25% of applicable NAV. For redemption/switch out of units after 30 days from the date of allotment: Nil |

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 0.22% |

| Direct | 0.13% |

| Including additional expenses and goods and service tax on management fees. (In addition to the above, the scheme will also incur 0.08% i.e total weighted average of the expense ratio levied by the underlying schemes.) Note: The investors will bear the recurring expenses of the Fund of Fund ('FoF') scheme in addition to the expenses of the Underlying Schemes in which Investments are made by the FoF scheme. |

|

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 83.25 Crores |

| AUM as on last day | 85.87 Crores |

| Date of Allotment | |

|---|---|

| October 31, 2023 |

| Benchmark | |

|---|---|

| Bloomberg US Treasury 1-3 Year Index |

|

|

||

|---|---|---|

Regular Plan |

Direct Plan |

|

| Growth | 10.2365 |

10.2404 |

| IDCW$: | 10.2354 |

10.2404 |

| $Income Distribution cum capital withdrawal | ||

| Other Parameters | |

|---|---|

| Modified Duration | 1.82 years |

| Average Maturity | 1.92 years |

| Yield to Maturity | 4.74% |

| Macaulay Duration | - |

| Application Amount for fresh subscription | |

|---|---|

| ₹ 10,000 (plus in multiplies of ₹ 1) |

| Min. Addl. Investment | |

|---|---|

| ₹ 5,000 (plus in multiplies of ₹ 1) |

| SIP | |

|---|---|

| Monthly: Minimum ₹ 100/- | |

| Fresh subscriptions/switch-in application(s) and existing systematic transactions are suspended until further notice with effect from 28th March, 2024 |

|

PORTFOLIO |

|

| Issuer | % to Net Assets |

| MUTUAL FUNDS | 96.87% |

| ISHARES USD TRSRY 1-3Y USD A | 82.96% |

| SPDR BLOOMBERG 1-3 YEAR U.S. T | 13.91% |

| Cash & Current Assets | 3.13% |

| Total Net Assets | 100.00% |