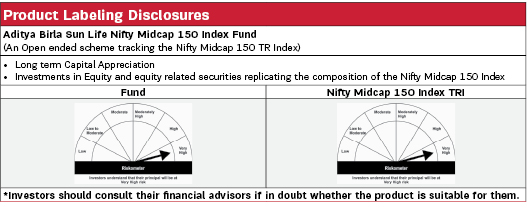

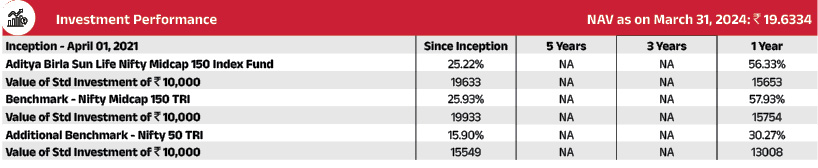

Aditya Birla Sun Life Nifty Midcap 150 Index Fund |

|

| An Open ended scheme tracking the Nifty Midcap 150 TR Index |

| Data as on 31st March 2024 |

|

Fund Details |

|

Investment Objective |

|

| The investment objective of the Scheme is to provide returns that closely correspond to the total returns of securities as represented by Nifty Midcap 150 Index, subject to tracking errors. The Scheme does not guarantee/indicate any returns. There can be no assurance that the schemes’ objectives will be achieved. |

|

|

| Fund Manager | |

|---|---|

| Mr. Haresh Mehta & Mr. Pranav Gupta |

| Managing Fund Since | |

|---|---|

| March 31, 2023 & June 08, 2022 |

| Experience in Managing the Fund | |

|---|---|

| 1.0 Years & 1.8 Years |

| Load Structure (as % of NAV) (Incl. for SIP) | |

|---|---|

| Entry Load | Nil |

| Exit Load | For redemption/switchout of units on or before 15 days from the date of allotment: 0.25% of applicable NAV. For redemption / switchout of units after 15 days from the date of allotment - NIL |

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 1.04% |

| Direct | 0.44% |

| Including additional expenses and goods and service tax on management fees. | |

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 168.33 Crores |

| AUM as on last day | 169.16 Crores |

| Date of Allotment | |

|---|---|

| April 01,2021 |

| Benchmark | |

|---|---|

| Nifty Midcap 150 Index TRI |

| Tracking Error | |

|---|---|

| Regular | 0.34% |

| Direct | 0.34% |

| Application Amount for fresh subscription | |

|---|---|

| ₹ 100 (plus in multiplies of ₹ 1) |

| Min. Addl. Investment | |

|---|---|

| ₹ 100 (plus in multiplies of ₹ 1) |

| SIP | |

|---|---|

| Monthly: Minimum ₹ 100/- |

|

|

||

|---|---|---|

| Regular Plan | Direct Plan | |

| Growth | 19.6334 | 20.0207 |

| IDCW$: | 19.6305 | 20.0204 |

| $Income Distribution cum capital withdrawal | ||

|

PORTFOLIO |

|

| Issuer | % to Net Assets |

| Banks | 8.08% |

| Yes Bank Limited | 1.49% |

| The Federal Bank Limited | 1.23% |

| IDFC First Bank Limited | 1.09% |

| Union Bank of India | 1.07% |

| AU Small Finance Bank Limited | 0.99% |

| Indian Bank | 0.67% |

| Bank of India | 0.62% |

| Bandhan Bank Limited | 0.54% |

| Bank of Maharashtra | 0.23% |

| IDBI Bank Limited | 0.16% |

| Industrial Products | 8.01% |

| Cummins India Limited | 1.49% |

| Supreme Industries Limited | 1.00% |

| APL Apollo Tubes Limited | 0.97% |

| Astral Limited | 0.90% |

| POLYCAB INDIA Limited | 0.86% |

| KEI INDUSTRIES LTD-INR 2 DEMAT EQ-INR 2 | 0.71% |

| AIA Engineering Limited | 0.57% |

| Carborundum Universal Limited | 0.51% |

| SKF India Limited | 0.35% |

| Grindwell Norton Limted | 0.32% |

| TIMKEN INDIA LTD | 0.32% |

| Auto Components | 7.98% |

| Tube Investments of India Limited | 1.45% |

| Sona BLW Precision Forgings Limited | 1.06% |

| Bharat Forge Limited | 1.06% |

| MRF Limited | 0.99% |

| Balkrishna Industries Limited | 0.67% |

| Apollo Tyres Limited | 0.56% |

| Minda Industries Ltd | 0.45% |

| Sundram Fasteners Limited | 0.43% |

| Schaeffler India Limited | 0.42% |

| Motherson Sumi Wiring India Limited | 0.41% |

| ZF Commercial Vehicle Control Systems India Limited | 0.26% |

| Endurance Technologies Limited | 0.23% |

| IT - Software | 7.58% |

| Persistent Systems Ltd | 3.01% |

| Coforge Limited | 1.23% |

| Tata Elxsi Limited | 0.99% |

| KPIT Technologies Limited | 0.88% |

| Oracle Financial Services Software Limited | 0.75% |

| MphasiS Limited | 0.73% |

| Pharmaceuticals & Biotechnology | 7.29% |

| Lupin Limited | 1.43% |

| Aurobindo Pharma Limited | 1.12% |

| Alkem Laboratories Limited | 0.91% |

| IPCA Laboratories Limited | 0.61% |

| Mankind Pharma Ltd | 0.61% |

| Laurus Labs Limited | 0.56% |

| Abbott India Limited | 0.53% |

| Gland Pharma Limited | 0.47% |

| Biocon Limited | 0.43% |

| Ajanta Pharmaceuticals Limited | 0.36% |

| GlaxoSmithKline Pharmaceuticals Limited | 0.29% |

| Finance | 5.13% |

| Sundaram Finance Limited | 1.02% |

| LIC Housing Finance Limited | 0.68% |

| Mahindra & Mahindra Financial Services Limited | 0.60% |

| Muthoot Finance Limited | 0.59% |

| Poonawalla Fincorp Limited | 0.50% |

| L&T Finance Holdings Limited | 0.47% |

| Aditya Birla Capital Limited | 0.45% |

| CRISIL Limited | 0.45% |

| Piramal Enterprises Limited | 0.37% |

| Electrical Equipment | 4.58% |

| Suzlon Energy Limited | 1.57% |

| CG Power and Industrial Solutions Limited | 1.27% |

| Bharat Heavy Electricals Limited | 1.16% |

| Thermax Limited | 0.58% |

| Realty | 4.24% |

| Macrotech Developers Limited | 1.11% |

| Godrej Properties Limited | 0.96% |

| Phoenix Mills Limited | 0.94% |

| Oberoi Realty Limited | 0.63% |

| Prestige Estates Projects Limited | 0.60% |

| Healthcare Services | 3.78% |

| Max Healthcare Institute Limited | 2.21% |

| Fortis Healthcare Limited | 0.80% |

| Syngene International Limited | 0.46% |

| Dr. Lal Path Labs Limited | 0.30% |

| Consumer Durables | 3.29% |

| Dixon Technologies (India) Limited | 1.03% |

| Voltas Limited | 0.92% |

| KALYAN JEWELLERS INDIA LTD | 0.35% |

| Kajaria Ceramics Limited | 0.35% |

| Bata India Limited | 0.32% |

| Kansai Nerolac Paints Limited | 0.19% |

| Metro Brands Limited | 0.13% |

| Chemicals & Petrochemicals | 3.21% |

| Solar Industries India Limited | 0.78% |

| Tata Chemicals Limited | 0.61% |

| Deepak Nitrite Limited | 0.53% |

| Linde India Limited | 0.50% |

| Gujarat Fluorochemicals Limited | 0.45% |

| Atul Limited | 0.33% |

| Issuer | % to Net Assets |

| Power | 2.99% |

| NHPC Limited | 1.02% |

| Torrent Power Limited | 0.83% |

| JSW Energy Limited | 0.83% |

| SJVN Limited | 0.31% |

| Fertilizers & Agrochemicals | 2.98% |

| PI Industries Litmited | 1.14% |

| UPL Limited | 0.84% |

| Coromandel International Limited | 0.46% |

| Bayer Cropscience Limited | 0.24% |

| Sumitomo Chemical India Limited | 0.16% |

| FERTILIZERS & CHEMICALS TRAVANCORE LIMIT | 0.15% |

| Capital Markets | 2.83% |

| HDFC Asset Management Company Limited | 1.38% |

| BSE Limited | 1.24% |

| ICICI Securities Limited | 0.21% |

| Leisure Services | 2.71% |

| The Indian Hotels Company Limited | 1.88% |

| Jubilant Foodworks Limited | 0.63% |

| Devyani International Limited | 0.21% |

| Cement & Cement Products | 2.17% |

| JK Cement Limited | 0.62% |

| ACC Limited | 0.62% |

| Dalmia Bharat Limited | 0.56% |

| The Ramco Cements Limited | 0.38% |

| Telecom - Services | 1.92% |

| Tata Communications Limited | 0.86% |

| Indus Towers Limited | 0.69% |

| Vodafone Idea Limited | 0.38% |

| Ferrous Metals | 1.81% |

| JSL STAINLESS LTD | 0.86% |

| Steel Authority of India Limited | 0.71% |

| Lloyds Metals & Energy Ltd | 0.24% |

| Insurance | 1.69% |

| Max Financial Services Limited | 0.90% |

| General Insurance Corporation Of India | 0.30% |

| Star Health & Allied Insurance Limited | 0.29% |

| The New India Assurance Company Limited | 0.21% |

| Financial Technology (Fintech) | 1.67% |

| PB Fintech Limited | 1.24% |

| One 97 Communications Limited | 0.43% |

| Gas | 1.61% |

| Petronet LNG Limited | 0.72% |

| Indraprastha Gas Limited | 0.55% |

| Gujarat Gas Limited | 0.34% |

| Transport Services | 1.52% |

| Container Corporation of India Limited | 0.88% |

| Delhivery Ltd | 0.64% |

| Retailing | 1.25% |

| FSN E-Commerce Ventures Limited | 0.81% |

| Aditya Birla Fashion and Retail Limited | 0.24% |

| Vedant Fashions Private Limited | 0.21% |

| Agricultural Commercial & Construction Vehicles | 1.24% |

| Ashok Leyland Limited | 0.90% |

| Escorts Kubota Limited | 0.34% |

| Petroleum Products | 1.11% |

| Hindustan Petroleum Corporation Limited | 1.11% |

| Textiles & Apparels | 1.04% |

| Page Industries Limited | 0.77% |

| K.P.R. Mill Limited | 0.27% |

| Transport Infrastructure | 0.96% |

| GMR Infrastructure Limited | 0.74% |

| JSW Infrastructure Ltd | 0.23% |

| Personal Products | 0.89% |

| Procter & Gamble Hygiene and Health Care Limited | 0.58% |

| Emami Limited | 0.31% |

| Minerals & Mining | 0.84% |

| NMDC Limited | 0.84% |

| IT - Services | 0.79% |

| L&T Technology Services Limited | 0.55% |

| Tata Technologies Ltd | 0.24% |

| Oil | 0.78% |

| Oil India Limited | 0.78% |

| Entertainment | 0.65% |

| Zee Entertainment Enterprises Limited | 0.47% |

| Sun TV Network Limited | 0.18% |

| Agricultural Food & other Products | 0.64% |

| Patanjali Foods Limited | 0.46% |

| Adani Wilmar Limited | 0.18% |

| Construction | 0.52% |

| Rail Vikas Nigam Limited | 0.52% |

| Industrial Manufacturing | 0.52% |

| Honeywell Automation India Limited | 0.31% |

| Mazagon Dock Shipbuilders Limited | 0.21% |

| Diversified | 0.50% |

| 3M India Limited | 0.32% |

| Godrej Industries Limited | 0.18% |

| Beverages | 0.47% |

| United Breweries Limited | 0.47% |

| Aerospace & Defense | 0.29% |

| Bharat Dynamics Limited | 0.29% |

| Non - Ferrous Metals | 0.27% |

| Hindustan Zinc Limited | 0.27% |

| Cash & Current Assets | 0.12% |

| Total Net Assets | 100.00% |

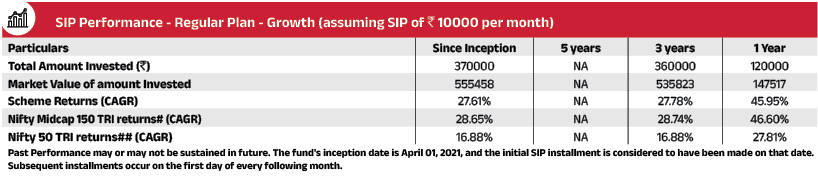

Past performance may or may not be sustained in future. The above performance is of Regular Plan - Growth Option. Kindly note that different plans have different expense structure. Load and Taxes are not considered for computation of returns. When scheme/additional benchmark returns are not available, they have not been shown. Total Schemes Co- Managed by Fund Managers is 15. Total Schemes managed by Mr. Haresh Mehta is 15. Total Schemes managed by Mr. Pranav Gupta is 17. Click here to know more on performance of schemes managed by Fund Managers.

Note: The exit load (if any) rate levied at the time of redemption/switch-out of units will be the rate prevailing at the time of allotment of the corresponding units. Customers may request for a separate Exit Load Applicability Report by calling our toll free numbers 1800-270-7000 or from any of our Investor Service Centers.

# Scheme Benchmark, ## Additional Benchmark

For SIP calculations above, the data assumes the investment of ₹ 10000/- on 1st day of every month or the subsequent working

day. Load & Taxes are not considered for computation of returns. Performance for IDCW option would assume reinvestment

of tax free IDCW declared at the then prevailing NAV. CAGR returns are computed after accounting for the cash flow by using

XIRR method (investment internal rate of return).Where Benchmark returns are not available, they have not been shown.

Past

performance may or may not be sustained in future. Returns greater than 1 year period are compounded annualized. IDCW

are assumed to be reinvested and bonus is adjusted. Load is not taken into consideration.