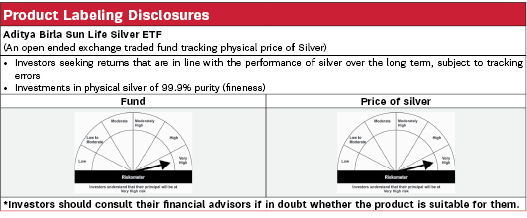

Aditya Birla Sun Life Silver ETF |

|

| An open ended exchange traded fund tracking physical price of Silver BSE Scrip Code: 543471 | Symbol: SILVER |

| Data as on 31st March 2024 |

|

Fund Details |

|

Investment Objective |

|

| The investment objective of the scheme is to generate returns that are in line with the performance of physical silver in domestic prices, subject to tracking error. The Scheme does not guarantee/indicate any returns. There can be no assurance that the schemes' objectives will be achieved. | |

|

| Fund Manager | |

|---|---|

| Mr. Sachin Wankhede |

| Managing Fund Since | |

|---|---|

| January 31, 2022 |

| Experience in Managing the Fund | |

|---|---|

| 2.2 Years |

| Load Structure (as % of NAV) (Incl. for SIP) | |

|---|---|

| Entry Load | Nil |

| Exit Load | Nil |

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 0.37% |

| Including additional expenses and goods and service tax on management fees. | |

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 195.77 Crores |

| AUM as on last day^ | 196.85 Crores |

| ^Net assets excludes aggregate investments by other schemes of Aditya Birla Sun Life Mutual Fund amounting to Rs. 80.42 Crs as on March 31, 2024. |

|

| Date of Allotment | |

|---|---|

| January 31, 2022 |

| Benchmark | |

|---|---|

| Price of silver |

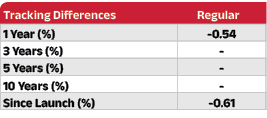

| Tracking Error | |

|---|---|

| Regular | 0.53% |

| Minimum Application Amount: | |

|---|---|

| For Transactions Directly with the Fund: | |

| For Market Makers: | The Creation Unit size shall be 30,000 units and in multiples of 1 unit thereof. |

| For Large Investors: | Min. application amount shall be Rs. 25 Crores and in multiples of Creation Unit Size |

| For Transactions on Stock Exchanges: | |

|---|---|

| Units of ETF scheme can be traded (in lots of 1 Unit) during the trading hours on all trading days on NSE and BSE on which the Units are listed. |

|

|

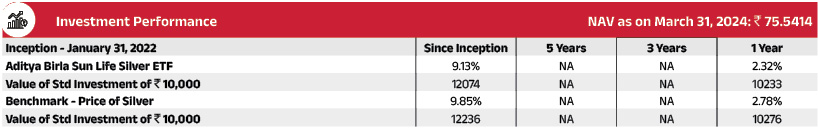

|---|

| 75.5414 |

|

PORTFOLIO |

|

| Issuer | % to Net Assets |

| SILVER | 97.36% |

| Silver | 97.36% |

| Cash & Current Assets | 2.64% |

| Total Net Assets | 100.00% |

Past performance may or may not be sustained in future. The above performance is of Regular Plan - Growth Option. Kindly note that different plans have different expense structure. Load and Taxes are not considered for computation of returns. When scheme/additional benchmark returns are not available, they have not been shown. Total Schemes managed by Mr. Sachin Wankhede is 3. Click here to know more on performance of schemes managed by Fund Managers.

Standard deviation of daily tracking difference computed for a 1 year horizon. If the fund is non-existent for 1 year then since inception returns are considered.

Note: The exit load (if any) rate levied at the time of redemption/switch-out of units will be the rate prevailing at the time of allotment of the corresponding units. Customers may request for a separate Exit Load Applicability Report by calling our toll free numbers 1800-270-7000 or from any of our Investor Service Centers.