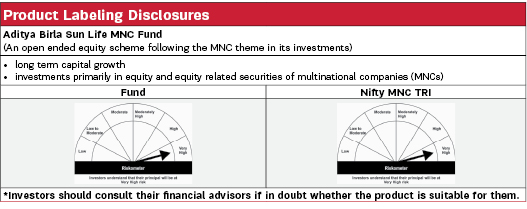

Aditya Birla Sun Life MNC Fund |

|

| An open ended equity scheme following the MNC theme in its investments |

| Data as on 31st March 2024 |

|

Fund Details |

|

Investment Objective |

|

| The objective of the scheme is to achieve long-term growth of capital at relatively moderate levels of risk by making investments in securities of multinational companies through a research based investment approach. | |

Fund Category |

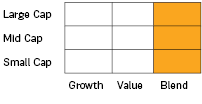

Investment Style |

||

| Sectoral/Thematic |  |

||

| Fund Manager | |

|---|---|

| Mr. Chanchal Khandelwal & Mr. Dhaval Joshi |

| Managing Fund Since | |

|---|---|

| December 28, 2021 & November 21, 2022 |

| Experience in Managing the Fund | |

|---|---|

| 2.3 years & 1.4 Years |

| Load Structure (as % of NAV) (Incl. for SIP) | |

|---|---|

| Entry Load | Nil |

| Exit Load | For redemption/switchout of units on or before 90 days from the date of allotment: 1.00% of applicable NAV. For redemption / switch-out of units after 90 days from the date of allotment: Nil. |

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 2.02% |

| Direct | 1.30% |

| Including additional expenses and goods and service tax on management fees. | |

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 3475.74 Crores |

| AUM as on last day | 3491.79 Crores |

| Date of Allotment | |

|---|---|

| December 27, 1999 |

| Benchmark | |

|---|---|

| Nifty MNC TRI |

| Other Parameters | |

|---|---|

| Standard Deviation | 11.44% |

| Sharpe Ratio | 0.00 |

| Beta | 0.79 |

| Portfolio Turnover | 0.22 |

| Note: Standard Deviation, Sharpe Ratio & Beta are calculated on Annualised basis using 3 years history of monthly returns. Risk Free Rate assumed to be 7.90% (FBIL Overnight MIBOR as on 31 March 2024) for calculating Sharpe Ratio | |

| Application Amount for fresh subscription | |

|---|---|

| ₹ 1,000 (plus in multiplies of ₹ 1) |

| Min. Addl. Investment | |

|---|---|

| ₹ 1,000 (plus in multiplies of ₹ 1) |

| SIP | |

|---|---|

| Daily/Weekly/Monthly: Minimum ₹ 100/- |

|

|

||

|---|---|---|

| Regular Plan | Direct Plan | |

| Growth | 1152.7900 | 1271.4300 |

| IDCW$: | 199.1000 | 406.7700 |

| $Income Distribution cum capital withdrawal | ||

|

PORTFOLIO |

|

| Issuer | % to Net Assets |

| Pharmaceuticals & Biotechnology | 11.19% |

| GlaxoSmithKline Pharmaceuticals Limited | 3.02% |

| Gland Pharma Limited | 2.15% |

| Pfizer Limited | 2.04% |

| Suven Pharmaceuticals Limited | 1.16% |

| Sanofi India Limited | 1.07% |

| Abbott India Limited | 0.79% |

| J.B. Chemicals & Pharmaceuticals Limited | 0.77% |

| Procter & Gamble Health Limited | 0.18% |

| Auto Components | 9.16% |

| Schaeffler India Limited | 3.63% |

| Bosch Limited | 2.67% |

| CIE Automotive India Ltd | 1.68% |

| Motherson Sumi Wiring India Limited | 0.93% |

| ZF Commercial Vehicle Control Systems India Limited | 0.24% |

| Industrial Products | 8.62% |

| Cummins India Limited | 4.52% |

| Grindwell Norton Limted | 1.22% |

| TIMKEN INDIA LTD | 1.16% |

| RHI Magnesita India Limited | 0.81% |

| SKF India Limited | 0.63% |

| ESAB India Ltd | 0.27% |

| Personal Products | 7.15% |

| Gillette India Limited | 3.63% |

| Procter & Gamble Hygiene and Health Care Limited | 3.51% |

| Consumer Durables | 6.88% |

| Bata India Limited | 2.36% |

| Whirlpool of India Limited | 1.56% |

| Kansai Nerolac Paints Limited | 1.47% |

| Johnson Controls - Hitachi Air Conditioning India Limited | 0.98% |

| Akzo Nobel India Limited | 0.52% |

| Automobiles | 5.68% |

| Maruti Suzuki India Limited | 5.68% |

| Beverages | 5.43% |

| United Spirits Limited | 2.78% |

| United Breweries Limited | 2.64% |

| Fertilizers & Agrochemicals | 5.01% |

| Bayer Cropscience Limited | 4.23% |

| Sumitomo Chemical India Limited | 0.78% |

| Finance | 4.71% |

| CRISIL Limited | 3.40% |

| Aavas Financiers Limited | 0.60% |

| SBFC Finance Ltd | 0.39% |

| Home First Finance Company India Limited | 0.31% |

| Electrical Equipment | 4.57% |

| Siemens Limited | 1.98% |

| ABB India Limited | 1.67% |

| Schneider Electric Infrastructure Limited | 0.51% |

| Hitachi Energy India Limited | 0.42% |

| Issuer | % to Net Assets |

| Capital Markets | 4.53% |

| ICRA Limited | 4.09% |

| Nippon Life India Asset Management Limited | 0.44% |

| Healthcare Services | 4.13% |

| Fortis Healthcare Limited | 4.13% |

| IT - Software | 4.12% |

| Coforge Limited | 2.43% |

| MphasiS Limited | 1.44% |

| Oracle Financial Services Software Limited | 0.25% |

| Industrial Manufacturing | 3.36% |

| Honeywell Automation India Limited | 3.36% |

| Leisure Services | 3.01% |

| Thomas Cook (India) Limited | 1.86% |

| Sapphire Foods India Ltd | 1.15% |

| Diversified FMCG | 2.93% |

| Hindustan Unilever Limited | 2.93% |

| Food Products | 2.08% |

| Nestle India Limited | 2.08% |

| Agricultural Commercial & Construction Vehicles | 1.13% |

| Escorts Kubota Limited | 1.13% |

| Diversified | 1.02% |

| 3M India Limited | 1.02% |

| Commercial Services & Supplies | 0.83% |

| Quess Corp Limited | 0.83% |

| Insurance | 0.78% |

| Star Health & Allied Insurance Limited | 0.78% |

| Transport Services | 0.75% |

| Blue Dart Express Limited | 0.75% |

| Cement & Cement Products | 0.64% |

| HeidelbergCement India Limited | 0.64% |

| Entertainment | 0.53% |

| Zee Entertainment Enterprises Limited | 0.53% |

| Chemicals & Petrochemicals | 0.48% |

| Linde India Limited | 0.48% |

| Household Products | 0.43% |

| DOMS Industries Limited | 0.43% |

| United States of America | 0.30% |

| Cognizant Technology Solutions Cl A Com Stk | 0.30% |

| Textiles & Apparels | 0.14% |

| Page Industries Limited | 0.14% |

| Miscellaneous | 0.00% |

| Jainpur Straw Brd | 0.00% |

| Maruti Cottex Limited | 0.00% |

| Sree Jayalakshmi Autospin Limited | 0.00% |

| Sri Venkatesha Mill Limited | 0.00% |

| Visakha Aqua Farm | 0.00% |

| Cash & Current Assets | 0.43% |

| Total Net Assets | 100.00% |

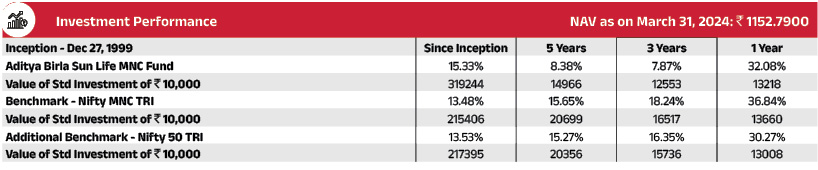

Past performance may or may not be sustained in future. The above performance is of Regular Plan - Growth Option. Kindly note that different plans have different expense structure. Load and Taxes are not considered for computation of returns. When scheme/additional benchmark returns are not available, they have not been shown. Total Schemes Co-Managed by Fund Managers is 3. Total Schemes managed by Mr. Chanchal Khandelwal is 4. Total Schemes managed by Mr. Dhaval Joshi is 51. Click here to know more on performance of schemes managed by Fund Managers.

Note: The exit load (if any) rate levied at the time of redemption/switch-out of units will be the rate prevailing at the time of allotment of the corresponding units. Customers may request for a separate Exit Load Applicability Report by calling our toll free numbers 1800-270-7000 or from any of our Investor Service Centers.

# Scheme Benchmark, ## Additional Benchmark

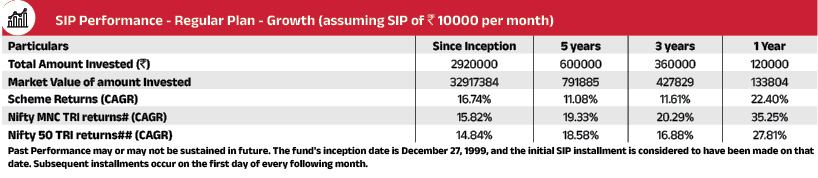

For SIP calculations above, the data assumes the investment of ₹ 10000/- on 1st day of every month or the subsequent working

day. Load & Taxes are not considered for computation of returns. Performance for IDCW option would assume reinvestment

of tax free IDCW declared at the then prevailing NAV. CAGR returns are computed after accounting for the cash flow by using

XIRR method (investment internal rate of return).Where Benchmark returns are not available, they have not been shown.

Past

performance may or may not be sustained in future. Returns greater than 1 year period are compounded annualized. IDCW

are assumed to be reinvested and bonus is adjusted. Load is not taken into consideration.