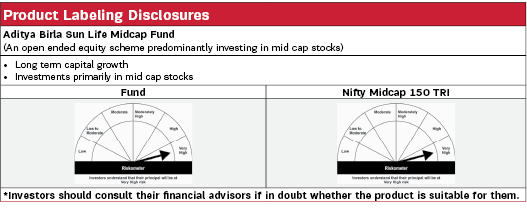

Aditya Birla Sun Life Midcap Fund |

|

| An open ended equity scheme predominantly investing in mid cap stocks. |

| Data as on 31st March 2024 |

|

Fund Details |

|

Investment Objective |

|

| The investment objective of the scheme is long term growth of capital at controlled level of risk by investing primarily in ‘Mid-Cap’ Stocks. | |

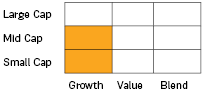

Fund Category |

Investment Style |

||

| Mid Cap Fund |  |

||

| Fund Manager | |

|---|---|

| Mr. Harish Krishnan & Mr. Dhaval Joshi |

| Managing Fund Since | |

|---|---|

| November 03, 2023 & November 21, 2022 |

| Experience in Managing the Fund | |

|---|---|

| 0.4 years & 1.4 Years |

| Load Structure (as % of NAV) (Incl. for SIP) | |

|---|---|

| Entry Load | Nil |

| Exit Load | For redemption /switchout of units on or before 90 days from the date of allotment: 1.00% of applicable NAV. For redemption / switch-out of units after 90 days from the date of allotment: Nil. |

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 1.92% |

| Direct | 1.07% |

| Including additional expenses and goods and service tax on management fees. | |

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 4890.69 Crores |

| AUM as on last day | 4912.51 Crores |

| Date of Allotment | |

|---|---|

| October 03, 2002 |

| Benchmark | |

|---|---|

| NIFTY Midcap 150 TRI |

| Other Parameters | |

|---|---|

| Standard Deviation | 13.60% |

| Sharpe Ratio | 1.02 |

| Beta | 0.87 |

| Portfolio Turnover | 0.23 |

| Note: Standard Deviation, Sharpe Ratio & Beta are calculated on Annualised basis using 3 years history of monthly returns. Risk Free Rate assumed to be 7.90% (FBIL Overnight MIBOR as on 31 March 2024) for calculating Sharpe Ratio | |

| Application Amount for fresh subscription | |

|---|---|

| ₹ 1,000 (plus in multiplies of ₹ 1) |

| Min. Addl. Investment | |

|---|---|

| ₹ 1,000 (plus in multiplies of ₹ 1) |

| SIP | |

|---|---|

| Daily/Weekly/Monthly: Minimum ₹ 100/- |

|

|

||

|---|---|---|

| Regular Plan | Direct Plan | |

| Growth | 637.1700 | 702.1600 |

| IDCW$: | 50.8100 | 85.7500 |

| $Income Distribution cum capital withdrawal | ||

|

PORTFOLIO |

|

| Issuer | % to Net Assets |

| Finance | 8.85% |

| Cholamandalam Financial Holdings Limited | 2.60% |

| Shriram Finance Ltd | 2.24% |

| Cholamandalam Investment and Finance Company Limited | 1.90% |

| Mahindra & Mahindra Financial Services Limited | 1.69% |

| GFL Limited | 0.31% |

| Aditya Birla Capital Limited | 0.11% |

| Banks | 7.56% |

| The Federal Bank Limited | 2.31% |

| AU Small Finance Bank Limited | 2.23% |

| ICICI Bank Limited | 1.65% |

| Bank of India | 0.62% |

| IndusInd Bank Limited | 0.51% |

| DCB Bank Limited | 0.24% |

| Auto Components | 7.13% |

| Bharat Forge Limited | 1.84% |

| Sona BLW Precision Forgings Limited | 1.27% |

| Tube Investments of India Limited | 0.99% |

| Endurance Technologies Limited | 0.79% |

| Schaeffler India Limited | 0.72% |

| Exide Industries Limited | 0.62% |

| Sundram Fasteners Limited | 0.54% |

| MRF Limited | 0.36% |

| Consumer Durables | 5.46% |

| Voltas Limited | 1.80% |

| Crompton Greaves Consumer Electricals Limited | 1.20% |

| Whirlpool of India Limited | 0.96% |

| Kansai Nerolac Paints Limited | 0.58% |

| V-Guard Industries Limited | 0.51% |

| Akzo Nobel India Limited | 0.42% |

| IT - Software | 5.28% |

| MphasiS Limited | 2.42% |

| Coforge Limited | 1.29% |

| Birlasoft Limited | 0.79% |

| LTIMindtree Limited | 0.79% |

| Pharmaceuticals & Biotechnology | 5.24% |

| Glenmark Pharmaceuticals Limited | 2.36% |

| Lupin Limited | 1.58% |

| Sanofi India Limited | 1.19% |

| Solara Active Pharma Sciences Limited | 0.10% |

| Industrial Products | 4.69% |

| Cummins India Limited | 2.29% |

| AIA Engineering Limited | 1.89% |

| Supreme Industries Limited | 0.49% |

| Happy Forgings Ltd | 0.02% |

| Chemicals & Petrochemicals | 4.32% |

| Gujarat Fluorochemicals Limited | 2.84% |

| Aarti Industries Limited | 1.11% |

| Atul Limited | 0.38% |

| Healthcare Services | 4.27% |

| Fortis Healthcare Limited | 2.82% |

| Apollo Hospitals Enterprise Limited | 1.29% |

| METROPOLIS HEALTHCARE LIMITED | 0.15% |

| Power | 3.69% |

| Torrent Power Limited | 3.69% |

| Cement & Cement Products | 3.43% |

| ACC Limited | 1.53% |

| JK Cement Limited | 0.94% |

| The Ramco Cements Limited | 0.82% |

| Dalmia Bharat Limited | 0.14% |

| Textiles & Apparels | 3.14% |

| K.P.R. Mill Limited | 3.14% |

| Issuer | % to Net Assets |

| Retailing | 2.89% |

| Info Edge (India) Limited | 1.14% |

| Aditya Birla Fashion and Retail Limited | 1.01% |

| Vedant Fashions Private Limited | 0.57% |

| FSN E-Commerce Ventures Limited | 0.18% |

| Realty | 2.86% |

| Phoenix Mills Limited | 2.86% |

| Electrical Equipment | 2.75% |

| Thermax Limited | 2.19% |

| Inox Wind Energy Limited | 0.56% |

| Beverages | 2.72% |

| Radico Khaitan Limited | 1.45% |

| United Breweries Limited | 0.68% |

| United Spirits Limited | 0.59% |

| Fertilizers & Agrochemicals | 2.56% |

| Coromandel International Limited | 2.56% |

| Ferrous Metals | 2.07% |

| Jindal Steel & Power Limited | 1.21% |

| Steel Authority of India Limited | 0.60% |

| NMDC Steel Ltd | 0.25% |

| Leisure Services | 2.02% |

| The Indian Hotels Company Limited | 1.39% |

| Jubilant Foodworks Limited | 0.64% |

| Insurance | 1.79% |

| Max Financial Services Limited | 1.79% |

| Capital Markets | 1.78% |

| Computer Age Management Services Limited | 1.07% |

| HDFC Asset Management Company Limited | 0.71% |

| Transport Services | 1.68% |

| Container Corporation of India Limited | 1.18% |

| Gateway Distriparks Limited | 0.50% |

| Minerals & Mining | 1.60% |

| NMDC Limited | 1.60% |

| Entertainment | 1.47% |

| Sun TV Network Limited | 0.98% |

| Zee Entertainment Enterprises Limited | 0.49% |

| Paper Forest & Jute Products | 1.31% |

| Century Textiles & Industries Limited | 1.31% |

| Automobiles | 1.30% |

| TVS Motor Company Limited | 1.30% |

| Aerospace & Defense | 1.23% |

| Bharat Electronics Limited | 1.23% |

| Gas | 1.15% |

| Indraprastha Gas Limited | 1.02% |

| Gujarat Gas Limited | 0.13% |

| Industrial Manufacturing | 1.11% |

| GMM Pfaudler Limited | 1.11% |

| Construction | 1.04% |

| Kalpataru Projects International Ltd. | 1.04% |

| Agricultural Commercial & Construction Vehicles | 0.87% |

| Ashok Leyland Limited | 0.87% |

| Agricultural Food & other Products | 0.61% |

| Tata Consumer Products Limited | 0.61% |

| Personal Products | 0.27% |

| Emami Limited | 0.27% |

| Transport Infrastructure | 0.15% |

| GMR Infrastructure Limited | 0.15% |

| EQUITY FUTURE | 0.09% |

| METROPOLIS HEALTHCARE LIMITED | 0.09% |

| Telecom - Services | 0.04% |

| Bharti Airtel Limited | 0.04% |

| Cash & Current Assets | 1.58% |

| Total Net Assets | 100.00% |

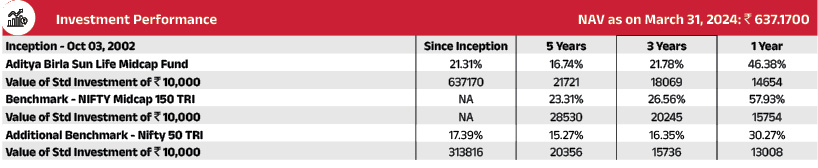

Past performance may or may not be sustained in future. The above performance is of Regular Plan - Growth Option. Kindly note that different plans have different expense structure. Load and Taxes are not considered for computation of returns. When scheme/additional benchmark returns are not available, they have not been shown. Total Schemes Co-Managed by Fund Managers is 2. Total Schemes managed by Mr. Harish Krishnan is 4. Total Schemes managed by Mr. Dhaval Joshi is 51. Click here to know more on performance of schemes managed by Fund Managers.

Note: The exit load (if any) rate levied at the time of redemption/switch-out of units will be the rate prevailing at the time of allotment of the corresponding units. Customers may request for a separate Exit Load Applicability Report by calling our toll free numbers 1800-270-7000 or from any of our Investor Service Centers.

# Scheme Benchmark, ## Additional Benchmark

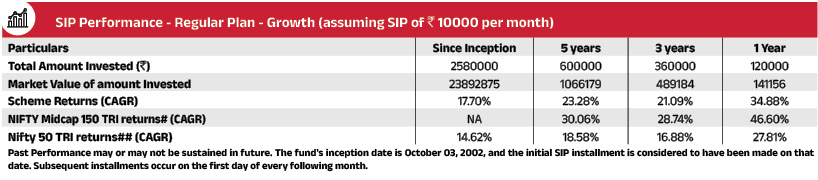

For SIP calculations above, the data assumes the investment of ₹ 10000/- on 1st day of every month or the subsequent working

day. Load & Taxes are not considered for computation of returns. Performance for IDCW option would assume reinvestment

of tax free IDCW declared at the then prevailing NAV. CAGR returns are computed after accounting for the cash flow by using

XIRR method (investment internal rate of return).Where Benchmark returns are not available, they have not been shown.

Past

performance may or may not be sustained in future. Returns greater than 1 year period are compounded annualized. IDCW

are assumed to be reinvested and bonus is adjusted. Load is not taken into consideration.