Aditya Birla Sun Life Short Term Fund |

|

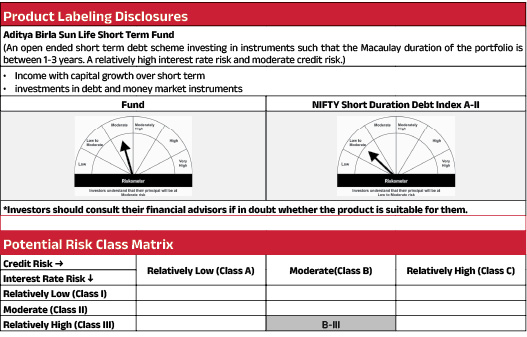

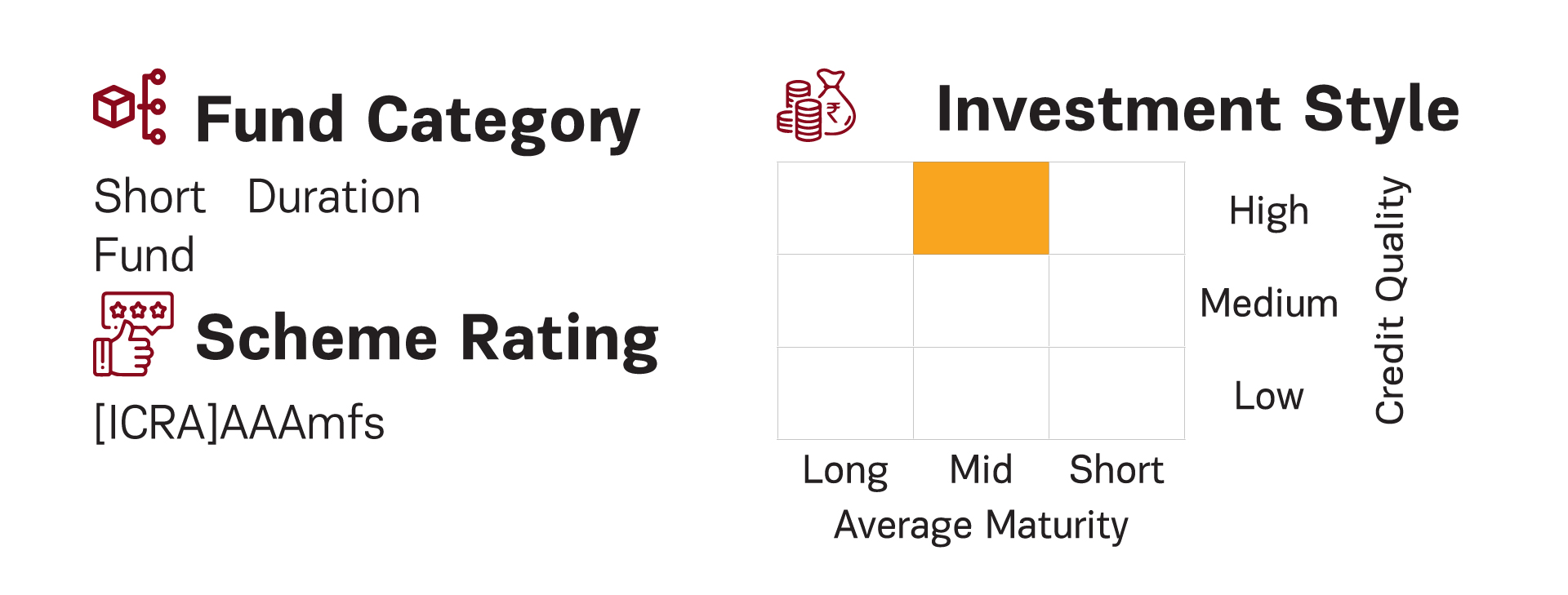

| An open ended short term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 1-3 years. A relatively high interest rate risk and moderate credit risk. |

| Data as on 31st March 2024 |

|

Fund Details |

|

Investment Objective |

|

| The investment objective of the Scheme is to generate income and capital appreciation by investing 100% of the corpus in a diversified portfolio of debt and money market securities. | |

|

| Fund Manager | |

|---|---|

| Mr. Kaustubh Gupta, Mr. Mohit Sharma & Mr. Dhaval Joshi |

| Managing Fund Since | |

|---|---|

| September 11, 2014, August 06, 2020 & November 21, 2022 |

| Experience in Managing the Fund | |

|---|---|

| 9.6 years, 3.7 years & 1.4 Years |

| Load Structure (as % of NAV) (Incl. for SIP) | |

|---|---|

| Entry Load | Nil |

| Exit Load | Nil |

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 0.97% |

| Direct | 0.38% |

| Including additional expenses and goods and service tax on management fees. | |

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 7031.25 Crores |

| AUM as on last day | 6767.47 Crores |

| Date of Allotment | |

|---|---|

| May 09, 2003 |

| Benchmark | |

|---|---|

| NIFTY Short Duration Debt Index A-II |

| Other Parameters | |

|---|---|

| Modified Duration | 2.86 years |

| Average Maturity | 4.21 years |

| Yield to Maturity | 7.87% |

| Macaulay Duration | 2.99 years |

|

|

||

|---|---|---|

Regular Plan |

Direct Plan |

|

| Growth | 43.0332 |

46.2014 |

| IDCW$: | 15.4759 |

11.0756 |

| Quarterly IDCW$: | 10.5411 |

11.0955 |

| $Income Distribution cum capital withdrawal | ||

| Application Amount for fresh subscription | |

|---|---|

| ₹ 1,000 (plus in multiplies of ₹ 1) |

| Min. Addl. Investment | |

|---|---|

| ₹ 1,000 (plus in multiplies of ₹ 1) |

| SIP | |

|---|---|

| Monthly: Minimum ₹ 1,000/- |

|

PORTFOLIO |

|

| Issuer | % to Net Assets |

Rating |

| Fixed rates bonds - Corporate | 49.14% | |

| Small Industries Development Bank of India | 2.72% | ICRA AAA |

| Bharti Telecom Limited | 2.22% | CRISIL AA+ |

| Embassy Office Parks REIT | 2.14% | CRISIL AAA |

| National Bank For Agriculture and Rural Development | 1.84% | CRISIL AAA |

| Small Industries Development Bank of India | 1.84% | ICRA AAA |

| Sundew Properties Limited | 1.50% | CRISIL AAA |

| Shriram Finance Ltd | 1.48% | CRISIL AA+ |

| LIC Housing Finance Limited | 1.47% | CARE AAA |

| Power Finance Corporation Limited | 1.47% | ICRA AAA |

| JM Financial Credit Solutions Ltd | 1.45% | ICRA AA |

| HDFC Bank Limited | 1.33% | ICRA AAA |

| Shriram Finance Ltd | 1.33% | IND AA+ |

| Small Industries Development Bank of India | 1.18% | CRISIL AAA |

| National Bank For Agriculture and Rural Development | 1.11% | ICRA AAA |

| Small Industries Development Bank of India | 1.10% | CRISIL AAA |

| Summit Digitel Infrastructure Private Limited | 1.08% | CRISIL AAA |

| TMF Holdings Limited | 1.03% | CRISIL AA |

| IndInfravit Trust | 1.01% | ICRA AAA |

| JM Financial Products Limited | 0.95% | ICRA AA |

| Tata Capital Limited | 0.95% | ICRA AAA |

| Tata Motors Finance Limited. | 0.88% | CRISIL AA |

| Mindspace Business Parks REIT | 0.87% | ICRA AAA |

| Mindspace Business Parks REIT | 0.74% | ICRA AAA |

| Tata Capital Limited | 0.74% | ICRA AAA |

| Power Finance Corporation Limited | 0.74% | ICRA AAA |

| ONGC Petro Additions Limited | 0.74% | ICRA AA |

| SMFG India Home Finance Company Limited | 0.74% | CRISIL AAA |

| Bajaj Housing Finance Limited | 0.74% | CRISIL AAA |

| Small Industries Development Bank of India | 0.74% | ICRA AAA |

| Larsen & Toubro Limited | 0.74% | CRISIL AAA |

| Hinduja Housing Finance Ltd | 0.74% | CARE AA |

| National Bank For Agriculture and Rural Development | 0.73% | ICRA AAA |

| Small Industries Development Bank of India | 0.73% | CRISIL AAA |

| Tata Capital Housing Finance Limited | 0.73% | ICRA AAA |

| Small Industries Development Bank of India | 0.73% | ICRA AAA |

| JM Financial Credit Solutions Ltd | 0.73% | ICRA AA |

| State Bank of India - Tier II - Basel III | 0.72% | ICRA AAA |

| REC Limited | 0.72% | ICRA AAA |

| Kotak Mahindra Prime Limited | 0.66% | ICRA AAA |

| Embassy Office Parks REIT | 0.66% | CRISIL AAA |

| National Bank For Agriculture and Rural Development | 0.59% | CRISIL AAA |

| Nexus Select Trust | 0.52% | ICRA AAA |

| Punjab National Bank - Tier II - Basel III | 0.51% | IND AAA |

| REC Limited | 0.37% | ICRA AAA |

| Tata Capital Housing Finance Limited | 0.37% | CRISIL AAA |

| Muthoot Finance Limited | 0.37% | ICRA AA+ |

| DLF Home Developers Ltd | 0.37% | ICRA AA |

| Power Finance Corporation Limited | 0.37% | ICRA AAA |

| HDFC Bank Limited | 0.37% | ICRA AAA |

| Power Finance Corporation Limited | 0.26% | ICRA AAA |

| REC Limited | 0.22% | ICRA AAA |

| REC Limited | 0.15% | CRISIL AAA |

| Reliance Industries Limited | 0.15% | CRISIL AAA |

| TATA Realty & Infrastructure Limited | 0.15% | ICRA AA+ |

| National Bank For Agriculture and Rural Development | 0.15% | ICRA AAA |

| Power Finance Corporation Limited | 0.07% | ICRA AAA |

| REC Limited | 0.07% | CRISIL AAA |

| NTPC Limited | 0.07% | ICRA AAA |

| Government Bond | 29.01% | |

| 7.26% GOVERNMENT OF INDIA 06FEB33 | 7.92% | SOV |

| 7.18% GOI 24-Jul-2037 | 6.77% | SOV |

| 7.18% GOVERNMENT ON INDIA 14AUG2033 GSEC | 6.63% | SOV |

| Issuer | % to Net Assets |

Rating |

| 7.17% GOVERNMENT OF INDIA 17APR30 | 2.15% | SOV |

| 7.17% GOI (MD 08/01/2028) | 1.38% | SOV |

| 7.10% GOVERNMENT OF INDIA 18APR29 | 1.33% | SOV |

| 4.70% INDIA GOVT BOND 22SEP2033 FRB | 1.20% | SOV |

| 7.06% GOI 10APR28 | 0.78% | SOV |

| 7.38% GOI 20JUN2027 | 0.55% | SOV |

| 5.22% GOVERNMENT OF INDIA 15JUN25 G-SEC | 0.29% | SOV |

| Floating rates notes - Corporate | 7.92% | |

| HDFC Bank Limited | 2.21% | ICRA AAA |

| Bharti Telecom Limited | 1.48% | CRISIL AA+ |

| Axis Finance Limited | 0.81% | CRISIL AAA |

| Mahindra Rural Housing Finance Limited | 0.44% | IND AA+ |

| DME Development Limited | 0.28% | CRISIL AAA |

| DME Development Limited | 0.28% | CRISIL AAA |

| DME Development Limited | 0.28% | CRISIL AAA |

| DME Development Limited | 0.28% | CRISIL AAA |

| DME Development Limited | 0.28% | CARE AAA |

| DME Development Limited | 0.28% | CRISIL AAA |

| DME Development Limited | 0.28% | CRISIL AAA |

| DME Development Limited | 0.27% | CRISIL AAA |

| DME Development Limited | 0.27% | CRISIL AAA |

| DME Development Limited | 0.27% | CRISIL AAA |

| HDFC Credila Financial Services Pvt Limited | 0.22% | CRISIL AAA |

| Money Market Instruments | 4.20% | |

| ICICI Bank Limited | 3.16% | ICRA A1+ |

| Sharekhan Ltd | 0.69% | ICRA A1+ |

| Panatone Finvest Limited | 0.35% | CRISIL A1+ |

| Cash Management Bills | 2.29% | |

| Government of India | 0.40% | SOV |

| Government of India | 0.32% | SOV |

| Government of India | 0.29% | SOV |

| Government of India | 0.14% | SOV |

| Government of India | 0.14% | SOV |

| Government of India | 0.13% | SOV |

| Government of India | 0.13% | SOV |

| Government of India | 0.13% | SOV |

| Government of India | 0.12% | SOV |

| Government of India | 0.12% | SOV |

| Government of India | 0.12% | SOV |

| Government of India | 0.11% | SOV |

| Government of India | 0.07% | SOV |

| Government of India | 0.05% | SOV |

| SECURITISED DEBT | 2.18% | |

| First Business Receivables Trust | 1.11% | IND AAA(SO) |

| First Business Receivables Trust | 1.07% | IND AAA(SO) |

| State Government bond | 1.39% | |

| 7.52% UTTAR PRADESH 27MAR2039 SDL | 0.37% | SOV |

| 8.83% TAMIL NADU 11JUN2024 SDL | 0.37% | SOV |

| 7.51% UTTAR PRADESH 27MAR2040 SDL | 0.33% | SOV |

| KARNATAKA 09.01% 25JUN24 SDL | 0.15% | SOV |

| 8.32% UTTAR PRADESH 02JUN2025 SDL | 0.07% | SOV |

| 8.05% HARYANA 25FEB2025 SDL | 0.06% | SOV |

| 8.60% BIHAR 09MAR2026 SDL | 0.01% | SOV |

| 7.51% UTTAR PRADESH 27MAR2038 SDL | 0.01% | SOV |

| 8.06% MAHARASHTRA 11FEB2025 SDL | 0.00% | SOV |

| Alternative Investment Funds (AIF) | 0.25% | |

| Corporate Debt Market Development Fund | 0.25% | |

| Interest Rate Swaps | 0.01% | |

| BNP Paribas - Indian branches | 0.01% | |

| BNP Paribas - Indian branches | 0.01% | |

| IDFC First Bank Limited | 0.00% | |

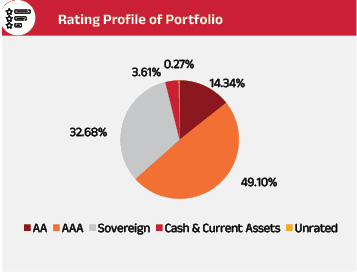

| Cash & Current Assets | 3.61% | |

| Total Net Assets | 100.00% |

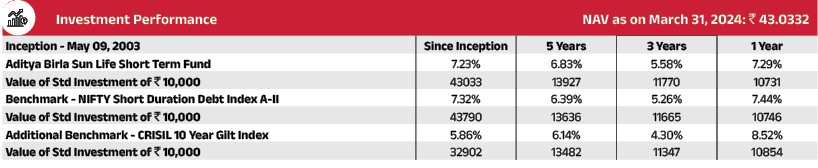

Past performance may or may not be sustained in future. The above performance is of Regular Plan - Growth Option. Kindly note that different plans have different expense structure. Load and Taxes are not considered for computation of returns. When scheme/additional benchmark returns are not available, they have not been shown. Total Schemes Co-Managed by Fund Managers is 2. Total Schemes managed by Mr. Kaustubh Gupta is 10. Total Schemes managed by Mr. Mohit Sharma is 19. Total Schemes managed by Mr. Dhaval Joshi is 51. Click here to know more on performance of schemes managed by Fund Managers.

Note: The exit load (if any) rate levied at the time of redemption/switch-out of units will be the rate prevailing at the time of allotment of the corresponding units. Customers may request for a separate Exit Load Applicability Report by calling our toll free numbers 1800-270-7000 or from any of our Investor Service Centers.