India headline real GDP growth data continued to be strong with recent GDP release showing that Indian economy grew by 8.2% in FY24 with strong 7.8% growth in the fourth quarter, both the numbers are higher than expectations. While we also believe that economy is recovering from Covid levels, our view is that headline GDP number is overstating the strength in the economy due to impact of a very low deflator and lower subsidy payments. Nominal Gross Value Added (GVA) which is shorn of these statistical effects grew by 8.5% year on year compared to pre-covid 10-year growth rate of ~12%.

Moreover, growth is still K-shaped in nature especially if we look into consumption pattern, housing market, tax collection numbers and commentary from consumer facing companies. The challenge for the new government will be to broaden the recovery.

Despite our somewhat less rosy view (relative to consensus) about the current state of economy we remain quite positive on the long-term growth momentum in the economy. We believe that India is on the cusp of a private capex cycle, and we also see consumption, which has been a drag in the economy, recovering from current momentum. Consumption is expected to get a boost from monsoon rainfall which is expected to be good and the new government likely to channel its energy towards boosting rural demand and focussing more on alleviating distress down the income pyramid. Our FY25 growth expectation is 7%, somewhat lower than RBI's expectation of 7.2%.

RBI's 7th June monetary policy was broadly status quo with no change in policy rate (with overnight Repo rate at 6.5%) or stance which stays at “withdrawal of accommodation”. With comfort on growth front, RBI is behaving like a classical inflation targeting central bank patiently waiting for inflation to align to its 4% target durably. However, the voting pattern of Monetary Policy Committee (MPC) showed a dovish tilt with 2 member of the 6 voting for a rate cut and stance change to neutral. We note that Indian inflation momentum in the economy is declining which will open up space for policy easing in second half of the fiscal year provided monsoon rainfall is normal. Even at 4.5% inflation (which is RBI's expectation for the year), the real policy rate at 2% is quite high and gives space for a shallow rate easing cycle, which we expect to unfold in 2HFY25.

Despite the somewhat surprising result of the General Election, the government formation has happened smoothly, and we expect broad continuity in policies, except for more focus on boosting employment and initiatives for the poor, farmers and rural communities.

There is some possibility of greater spending by government than envisaged in the interim budget, but we note that the Central Bank, RBI, has given a very high dividend this year which creates fiscal buffer for the government. The higher dividend from the Central Bank was largely a result of higher income which the Central Bank earns on its investment in foreign securities as part of forex reserves management owing to higher global rates. Overall, we expect government to continue with fiscal consolidation roadmap and would point out that recent data shows that even in last pre-election year, the fiscal deficit turned out to be lower than budgeted (5.6% of GDP against budgeted 5.8%).

In another major development, rating agency S&P Global has upgraded India's sovereign rating outlook to positive from stable and affirmed the 'BBB-' long-term local currency sovereign credit ratings. We are also approaching the inclusion of India into JP Morgan Emerging Market Bond Indices in June end. FII inflows into Indian bonds remain healthy with close to close to US$11.7bn having already flows in since the announcement of India's inclusion.

Our outlook on Indian bonds continues to be constructive due to fiscal health, lower supply from government, receding inflation, stable INR and upcoming inclusion to global/EM bond indices. The key risks that we are closely watching is largely global in nature: impact of geopolitical risks on oil price and US inflation turning out to be sticky.

We remain overweight on duration but would be keenly watching the next budget for the government's commitment towards fiscal consolidation. We believe that the cocktail of below target core inflation, favourable demand and supply backdrop for bonds, the beginning of developed markets (DM) rate cutting cycles and high real rates will lead to a duration rally taking the 10Y to ~6.75% this year.

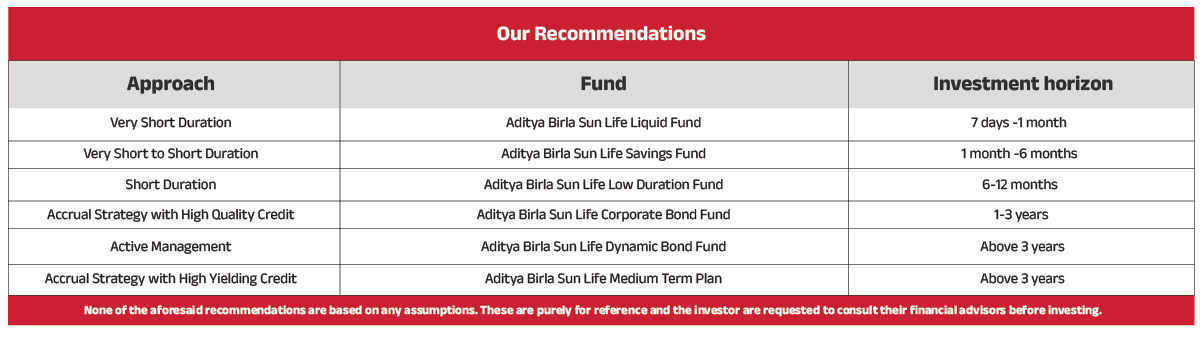

For 2024, investors should dial active duration risk through short-term funds (Short term fund, corporate bond fund, and Banking & PSU fund). Actively managed duration funds aim to do well this year. Investors who want to benefit from index inclusion related inflows into Indian Government Bonds should invest in our actively managed Gilt funds and our passively managed Index funds investing in GSecs. Ultra short-term investors should look to invest in money market, ultra-short-term funds & low duration funds

Source: CEIC, Bloomberg, RBI

Data as on 7th June 2024

This document represents the views of Aditya Birla Sun Life AMC Limited and for information purpose and must not be taken as the basis for an investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.